Is There Underpricing After Moroccan IPOs?

DOI :

https://doi.org/10.5281/zenodo.15371119Mots-clés :

Moroccan Capital Market; Initial public offering; Initial returns; Underpricing.Résumé

Abstract

This study aims to analyze the phenomenon of underpricing in the Moroccan market. When underpricing occurs, investors can get a positive initial return. Underpricing is then the practice of listing an initial public offering (IPO) at a price lower than its real value in the stock market.

This is a well-documented and widely studied anomaly in finance, and was explained by several theories such as Information Asymmetry (Winner’s Curse), Signaling Theory, Agency Theory, and other Behavioral Theories. Many works on the international scale highlighted the prevalence of underpricing in IPOs, discussing factors influencing the decision to underprice and its impact on market efficiency.

This study examines the evolution of initial returns (both adjusted and non-adjusted) and tests the computation of initial returns (IRs) using the Student’s t-test as the data analysis method, to affirm or reject the null hypothesis. The data are sourced from the prospectus and financial statements of companies after their Initial Public Offering (IPO). The sample consists of 35 companies listed on the Moroccan stock market from 2004 to 2020. The findings confirm the phenomenon of initial underpricing in the Moroccan context, consistent with international studies. However, our work suggests that further research is needed to explore the factors contributing to this underpricing, particularly those related to the characteristics of Moroccan companies and the economic conditions surrounding the IPO event, both pre- and post-IPO. This opens avenues for future research on the factors that drive the decision to underprice and how this affects the Moroccan market efficiency.

Keywords: Moroccan Capital Market; Initial public offering; Initial returns; Underpricing.

Téléchargements

Publiée

Comment citer

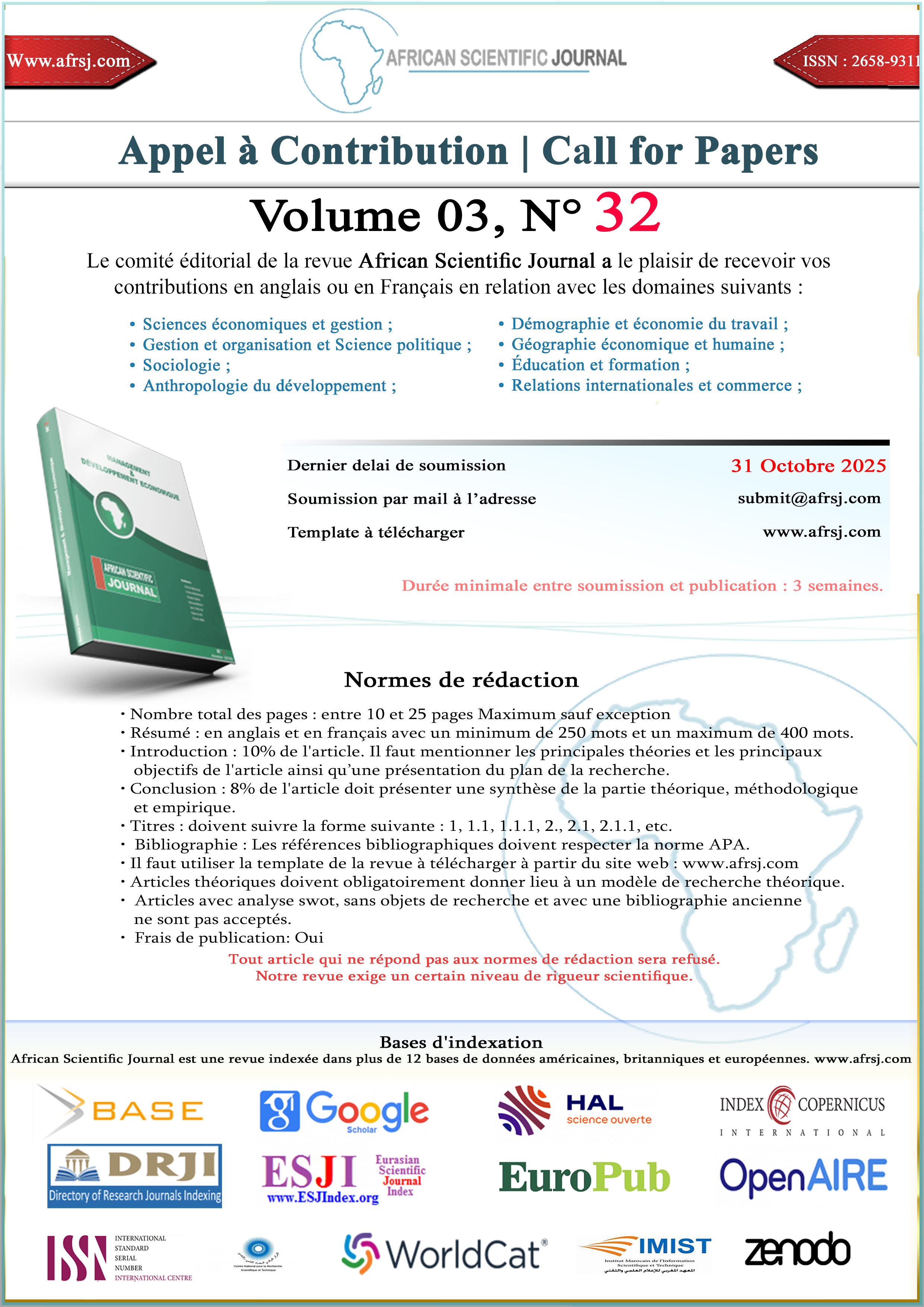

Numéro

Rubrique

Licence

(c) Tous droits réservés African Scientific Journal 2025

Ce travail est disponible sous licence Creative Commons Attribution - Pas d'Utilisation Commerciale - Pas de Modification 4.0 International.