Foreign Direct Investment and Tax Revenue in Morocco : The Moderating Role of Trade Openness

DOI :

https://doi.org/10.5281/zenodo.17521572Résumé

Abstract

In the context of increasing globalization, foreign direct investment (FDI) is widely acknowledged as a significant source of external financing for countries. This study aims to empirically evaluate the influence of FDI on tax revenues in Morocco while considering the moderating effect of trade openness. The research covers the period from 1990 to 2022. The results obtained through Generalized Method of Moments (GMM) modeling reveal that both inward and outward FDI have a negative impact on Morocco's tax structure. These findings can primarily be attributed to tax optimization strategies and the relocation practices of multinational companies. Additionally, when examining the interactive term of the transmission channels of trade openness, which includes customs duties, import liberalization, export promotion, and exchange rate variability, it is observed that trade taxes decrease, while domestic tax revenues increase.

Keywords : FDI, Tax revenues, Trade openness, GMM

Téléchargements

Publiée

Comment citer

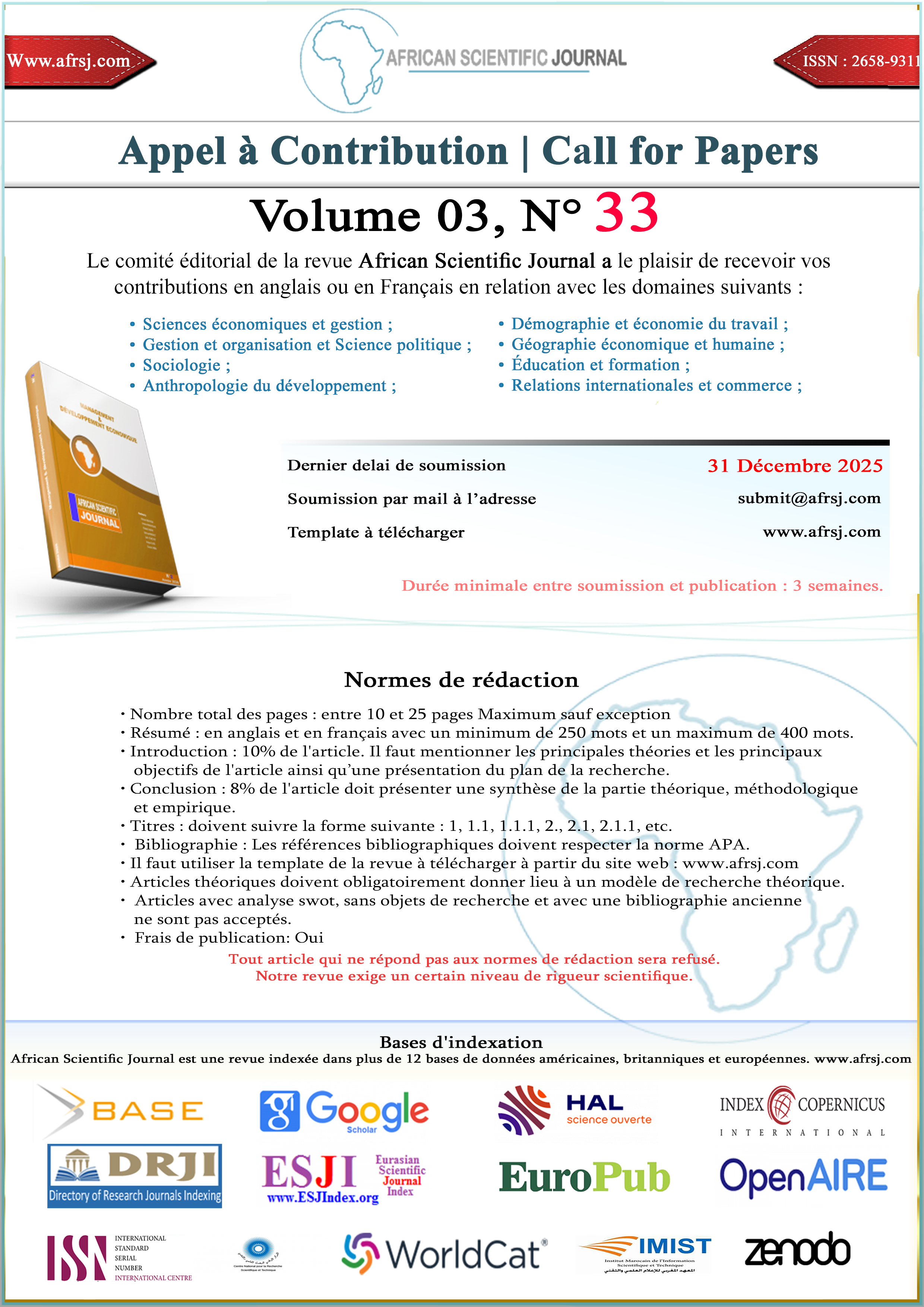

Numéro

Rubrique

Licence

(c) Tous droits réservés African Scientific Journal 2025

Ce travail est disponible sous licence Creative Commons Attribution - Pas d'Utilisation Commerciale - Pas de Modification 4.0 International.