Digital Transformation and Financial Inclusion: A Strategic Imperative for Morocco's Banking Sector

DOI :

https://doi.org/10.5281/zenodo.8379948Mots-clés :

Moroccan banking sector, digital economy, digital transformation process, financial servicesRésumé

This paper studies the current state of the Moroccan banking system in the context of digital economy development, to establish the benchmarks and needs for banking regulation, and to study the potential possibilities of digitalization of relations and transactions in the banking sector in the mechanism of implementing prudential rules. Digital transformation in the banking industry is associated with obstacles that seem to hinder the smooth implementation of digital approaches. This issue has not been adequately addressed in the current academic literature. The main purpose of this qualitative exploratory study is to identify the main perceived obstacles to digital transformation in the Moroccan commercial banking sector from a point of view and to analyse them accordingly. However, challenges such as low financial penetration and mismatches with costumer needs persists. The digitalization of financial services emerges as a promosing avenue to address these issues, significantly increasing financial access and inclusion in Morocco, in line with trends observed in other African Nations.

Téléchargements

Publiée

Comment citer

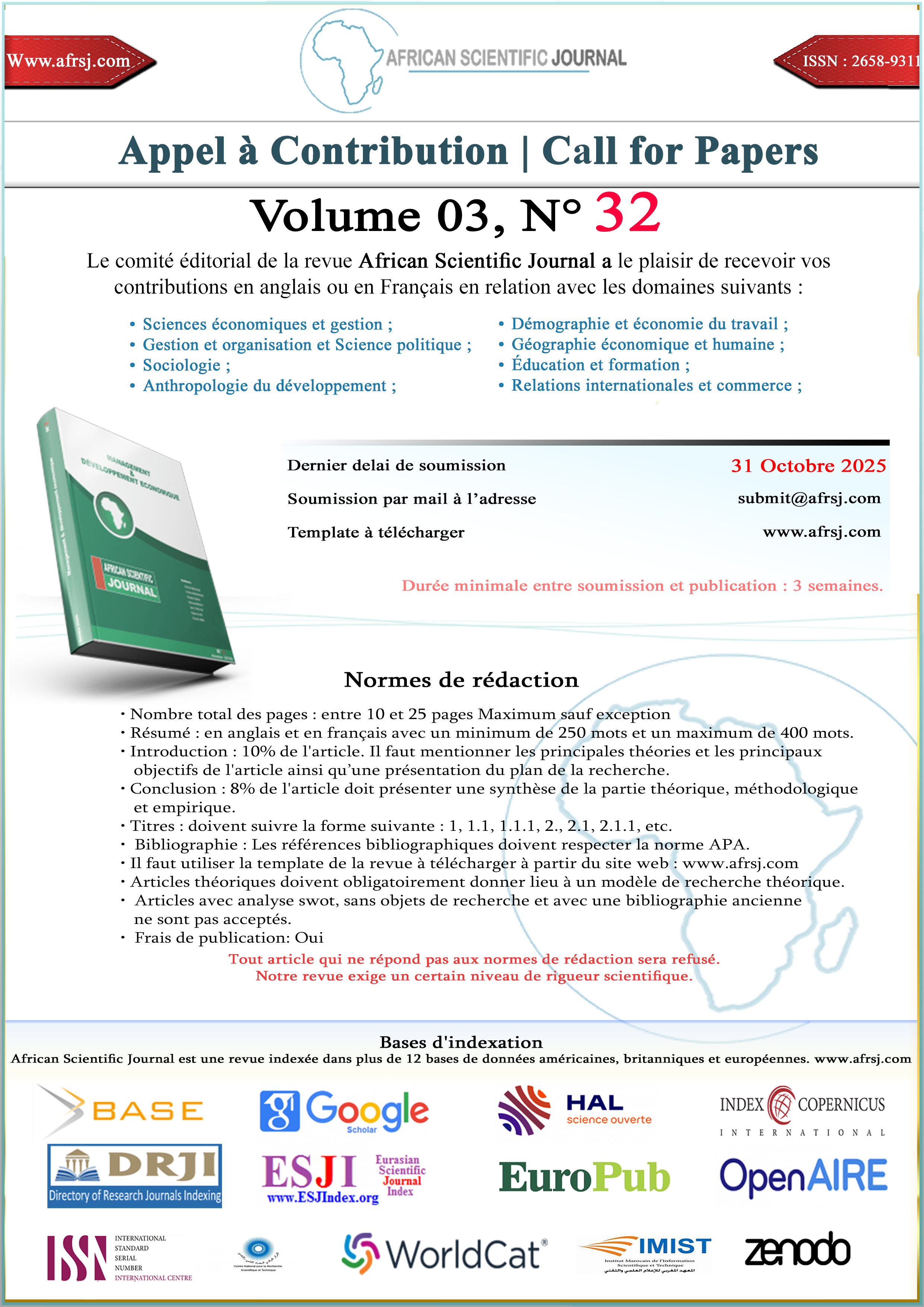

Numéro

Rubrique

Licence

(c) Tous droits réservés African Scientific Journal 2023

Ce travail est disponible sous licence Creative Commons Attribution - Pas d'Utilisation Commerciale - Pas de Modification 4.0 International.