The effect of the fiscal and monetary policies interaction on the economic growth in Morocco – An ARDL approach

DOI :

https://doi.org/10.5281/zenodo.10156268Mots-clés :

Fiscal policy, Monetary policy, GDP growth, ARDLRésumé

This research paper aims to empirically investigate the effect of the interaction between fiscal and monetary policies on the real GDP growth in Morocco. We use Auto-Regressive Distributive Lag Bounds Model (ARDL Bounds test) for co-integration and the Error Correction Model (ECM) in the ARDL, for the period from Q1-2000 to Q2-2023 to analyze the short-run and long-run effects. The main results conclude that there is a co-integration between fiscal and monetary policies and they both affect GDP growth in Morocco which reflects their key role in promoting growth. At the long-run. Fiscal policy is more effective than monetary policy. In the short term, the impact of monetary policy through interest rate instrument is greater than fiscal policy variables. Thus, strengthening coordination between monetary authorities and Government and increasing fiscal space would reinforce their respective capacity to converge towards an optimal policy mix oriented to support economic activity and improve the resilience of the Moroccan economy.

Téléchargements

Publiée

Comment citer

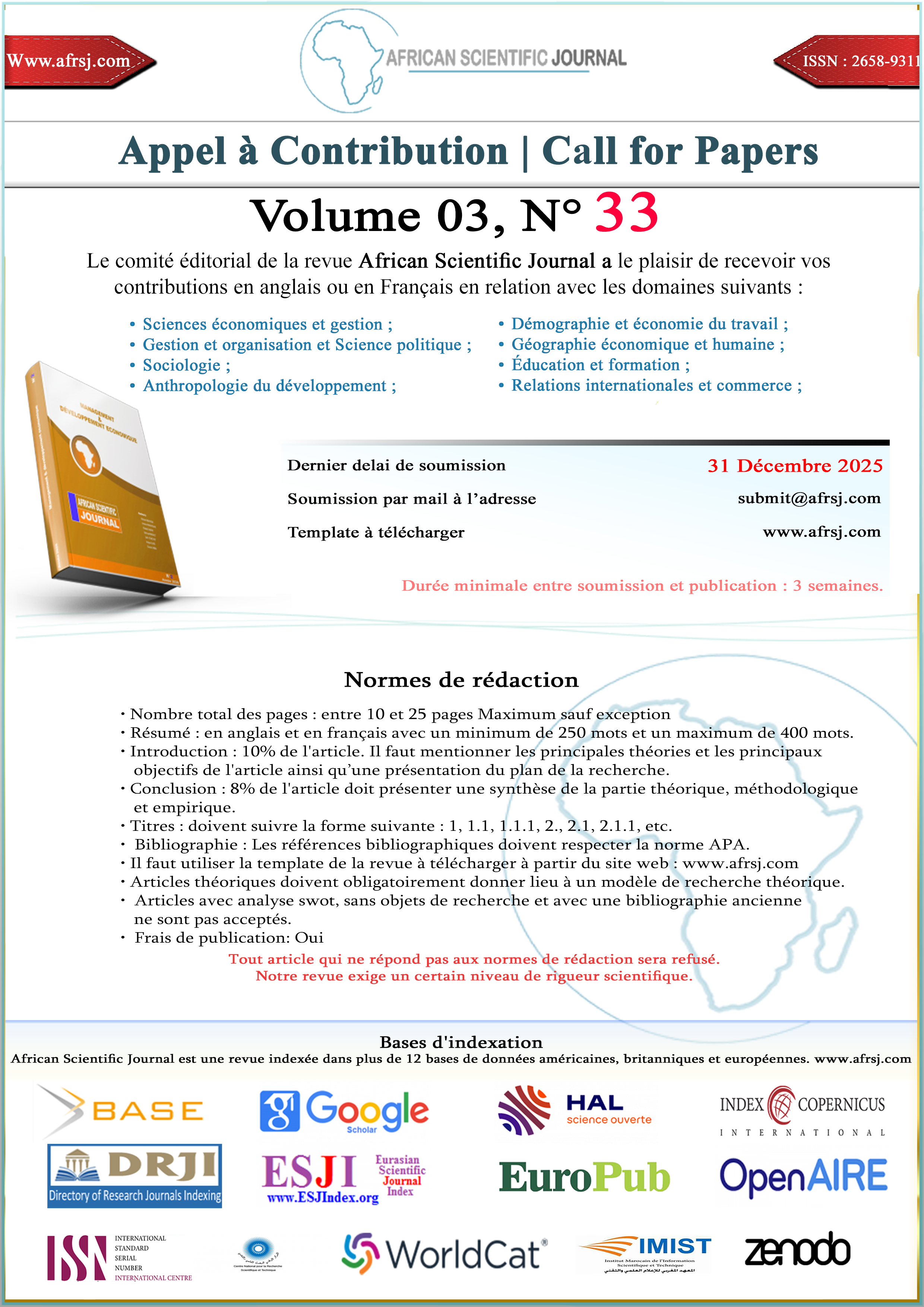

Numéro

Rubrique

Licence

(c) Tous droits réservés African Scientific Journal 2023

Ce travail est disponible sous licence Creative Commons Attribution - Pas d'Utilisation Commerciale - Pas de Modification 4.0 International.