The Impact of Monetary Policy on Private Investment in Morocco: An Analysis Using a VECM Model.

DOI:

https://doi.org/10.5281/zenodo.10123861Keywords:

Private investment, Policy rate, Monetary policyAbstract

The aim of this article is to analyze the relationship between monetary policy and private investment in Morocco. It explains how private sector investors react to changes in monetary policy decisions. Our study aims to understand the effect of monetary policy action on private investment in Morocco over the period 1995-2020, using the VECM method. The results indicate that in the long term, the policy rate and the money supply have a negative and significant impact on private investment, while the exchange rate and credit granted to the private sector have a positive and significant impact on private investment.

Downloads

Published

How to Cite

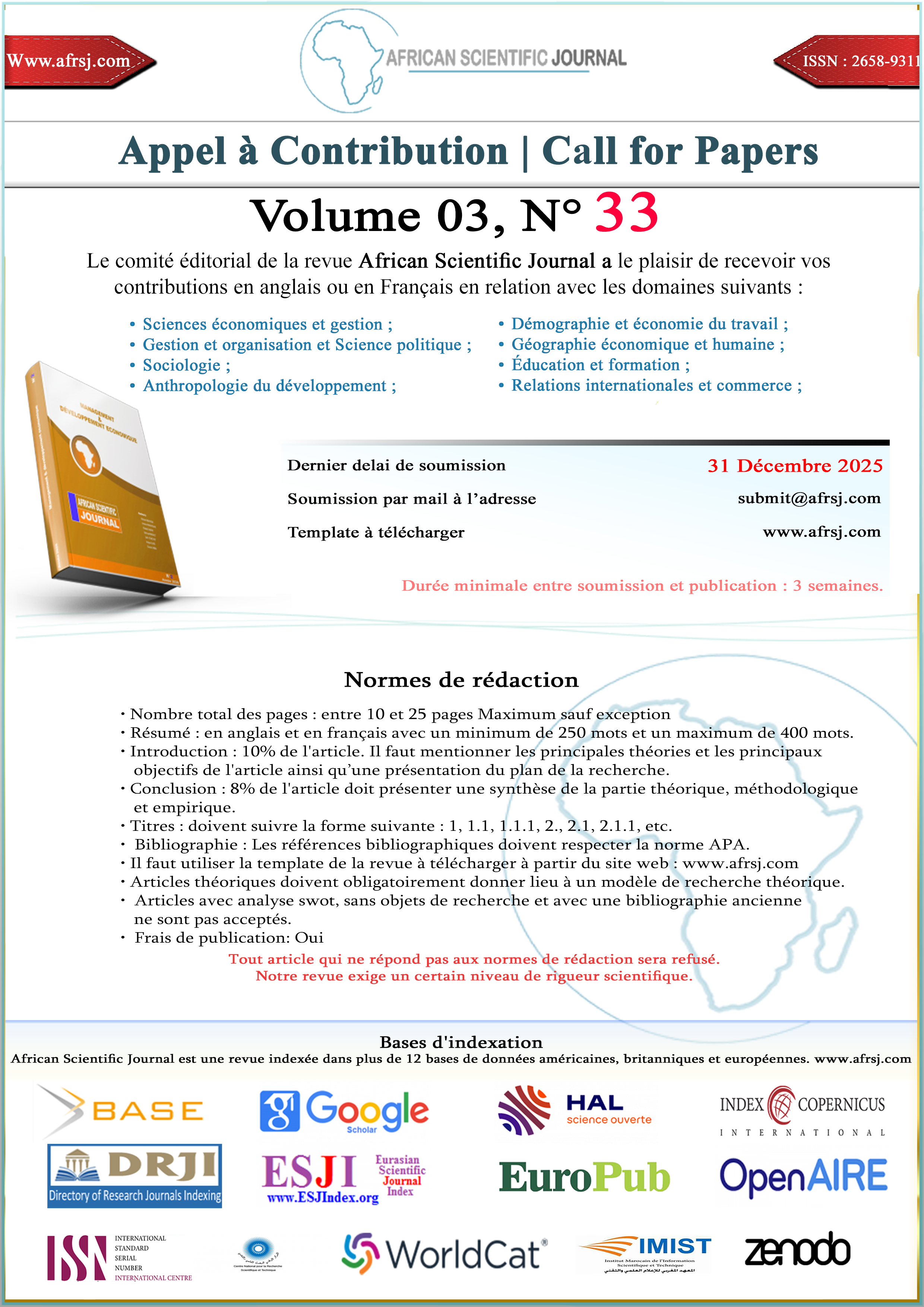

Issue

Section

License

Copyright (c) 2023 African Scientific Journal

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.